Outrageous Predictions for 2022, Apple Wins in China, Inflationary Expectations, and the Dividends of Wine Investing.

Just the Best Investing and Business Insights

If you don’t have a Seersite account, sign up for free at seersite.com, or download the Seersite app on iOS or Android.

Most Read on Seersite This Week

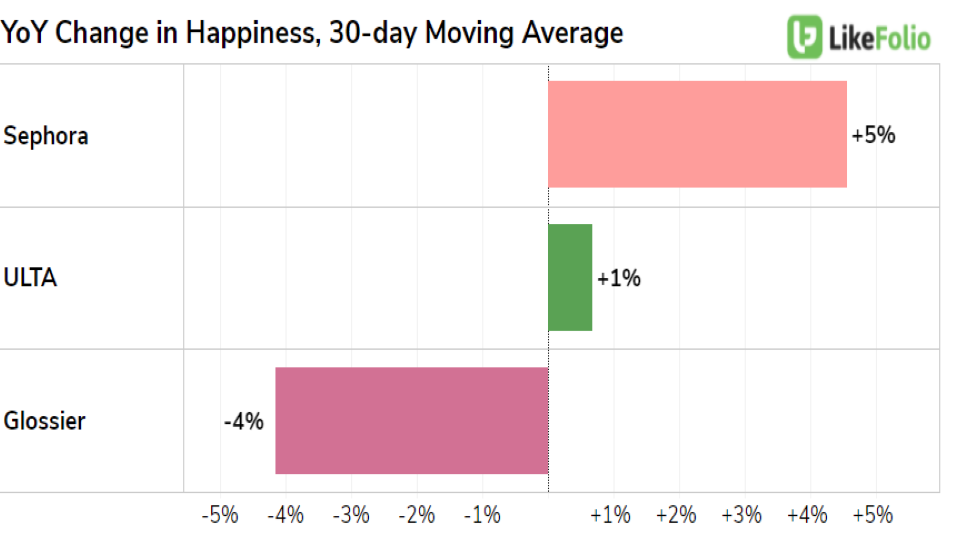

Will Cosmetics Demand Propel ULTA Higher? | LikeFolio. Last year consumers wore (and bought) less makeup when they were stuck at home and avoiding social activities. Now things have shifted. Store traffic is increasing, digital demand shows dtickiness, and Ulta makeup demand is coming back. Ulta remains the top downloaded app in the beauty space.

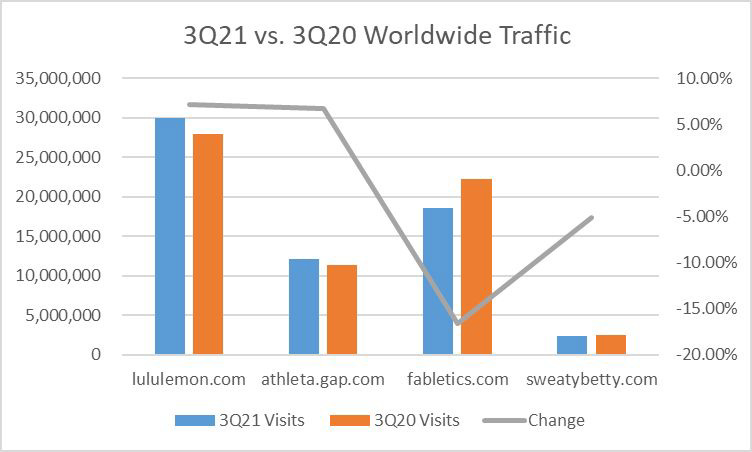

Lululemon Earnings Preview 3Q21 | Similarweb. Lululemon, performed well during the pandemic and continues to grow its market share. Athleisure brands saw a significant jump in traffic in 2020. Lululemon.com’s worldwide traffic alone saw a rise of nearly 55% from 2019. It's a trend that we saw continue into 2021, though the surge in growth is now starting to meet resistance.

Outrageous Predictions for 2022 Look More Likely Than Usual | Blain's Morning Porridge. Saxo’s Outrageous Predictions for 2022 include a rain check on ESG fundamentalism holding back fossil fuel investments necessary to enable energy transition to new reliable renewable sources. It’s one of these things that has to happen, or else energy instability will crush economies.

APAC Notable Consumer Finance Private Companies | Lightstream Research. We have provided an overview and an analysis of the top 10 private consumer finance companies in APAC with a total equity value of more than US$1bn, including their business models, lending products, monetisation, key drivers, funding and valuation. We have also discussed their potential IPO plans and timelines as investment opportunities.

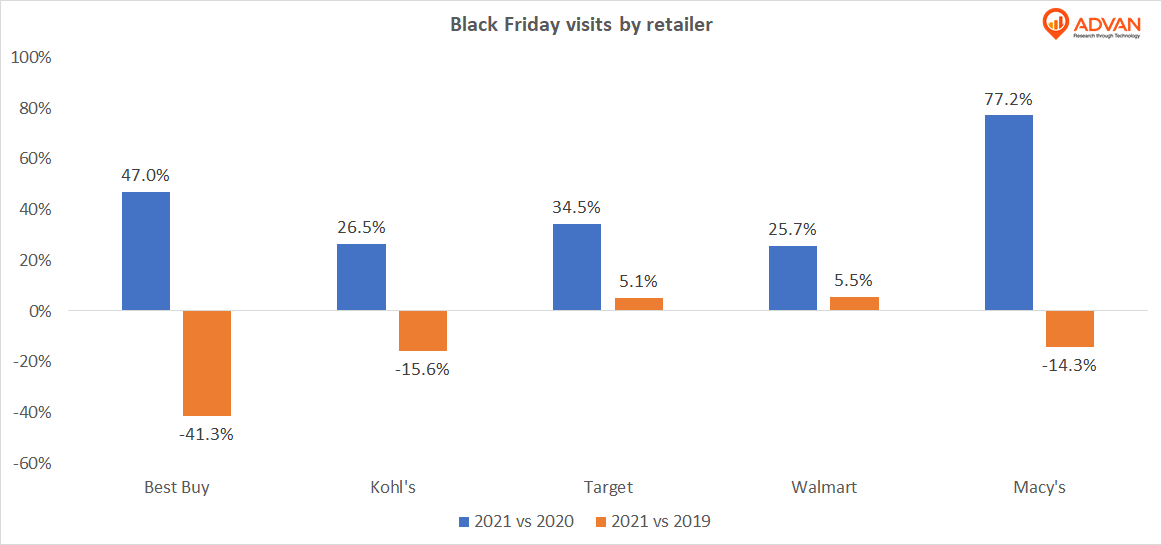

Black Friday In-Store Shopping Lower Than Pre-Pandemic Levels | Advan. Traffic on Black Friday after Thanksgiving was materially higher across Advan Indices compared with last year’s levels. Visits at Retail Stores were down 13% compared to 2019 levels but still up almost 40% versus the Black Friday last year. However, not all the retailers counted fewer customers walking into their brick-and-mortar premises.

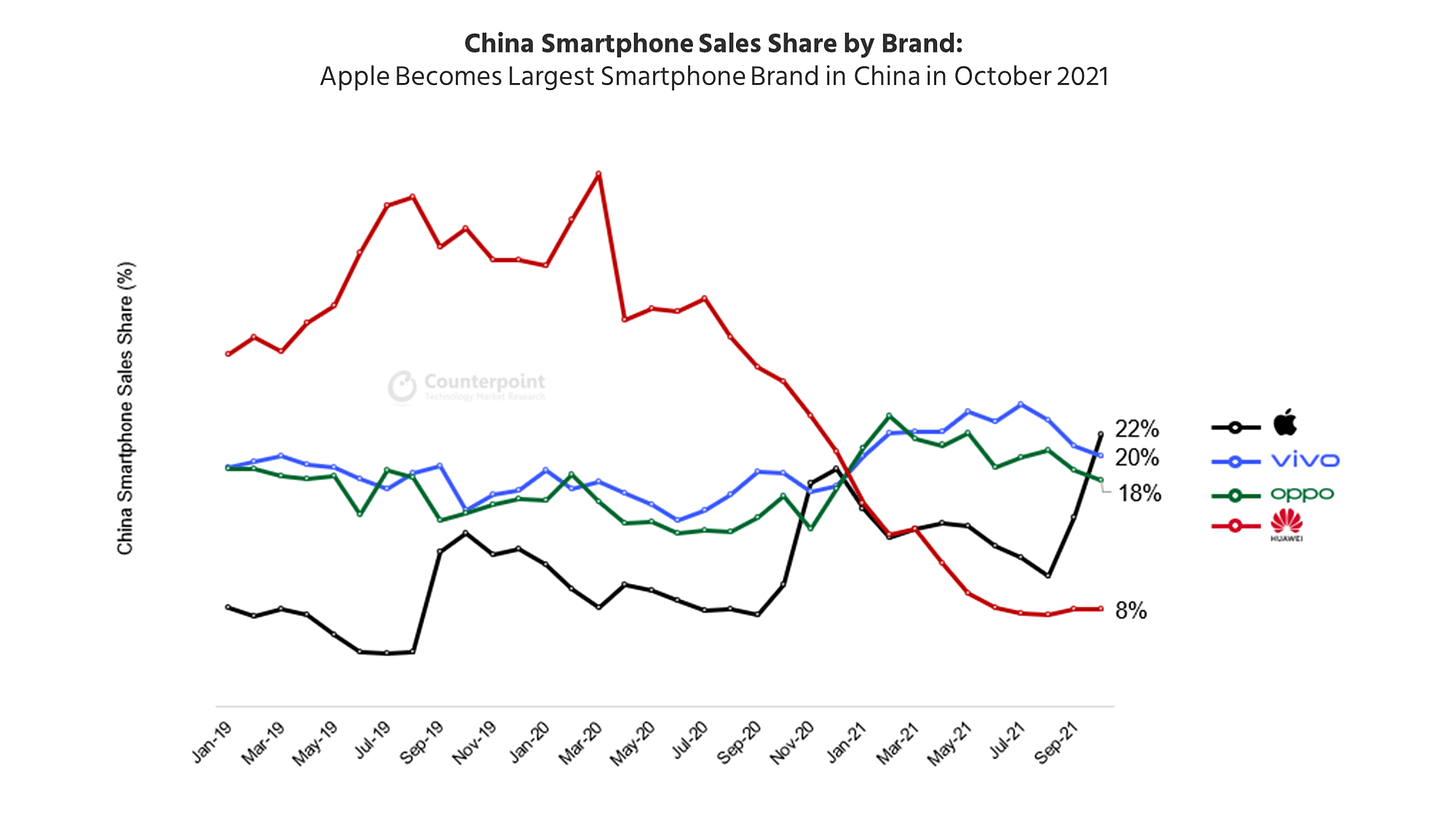

Chart of the Week - Apple Becomes Largest Smartphone Brand in China in October 2021

Apple surpassed Vivo in October 2021 to become the largest smartphone OEM in China for the first time since December 2015. Driven by the iPhone 13 series, Apple’s sales grew 46% MoM, the highest among all major OEMs in the country. In comparison, China’s smartphone market grew only 2% MoM in October. Apple’s stellar show came at a time when many consumers were delaying their purchases ahead of the Singles’ Day sales in November. Other key OEMs saw MoM declines in their October sales (read, from Counterpoint Technology Market Research).

Inflation

“Inflation is like toothpaste – once you got it out, you can’t get it back in again.” argues Blain’s Morning Porridge. “Traditional inflation responses like austerity, raising taxes, tighter monetary policy, are as likely to cause market instability and generate increased expectations to push inflation as to ease it.” Topdown Charts shows just how far the Fed has lagged behind inflation expectations, while RockDen Advisors warns that Powell’s faster taper comment “is also a sign of politicization of the Fed and, consequent, policy risks.”

Contributor Spotlight: Topdown Charts

Topdown Charts: chart driven macro insights for investors. Topdown Charts is a chart-driven independent research provider covering global asset allocation and economics. Topdown Charts covers multiple economies, markets, and asset classes with a distinctive chart-driven focus to bring valuable insights to investors, portfolio managers, and investment professionals. The perspective is that of an investor, and the multi-asset scope lends itself to both asset allocators and asset class specific portfolio managers. Read Topdown Chart's insights here.

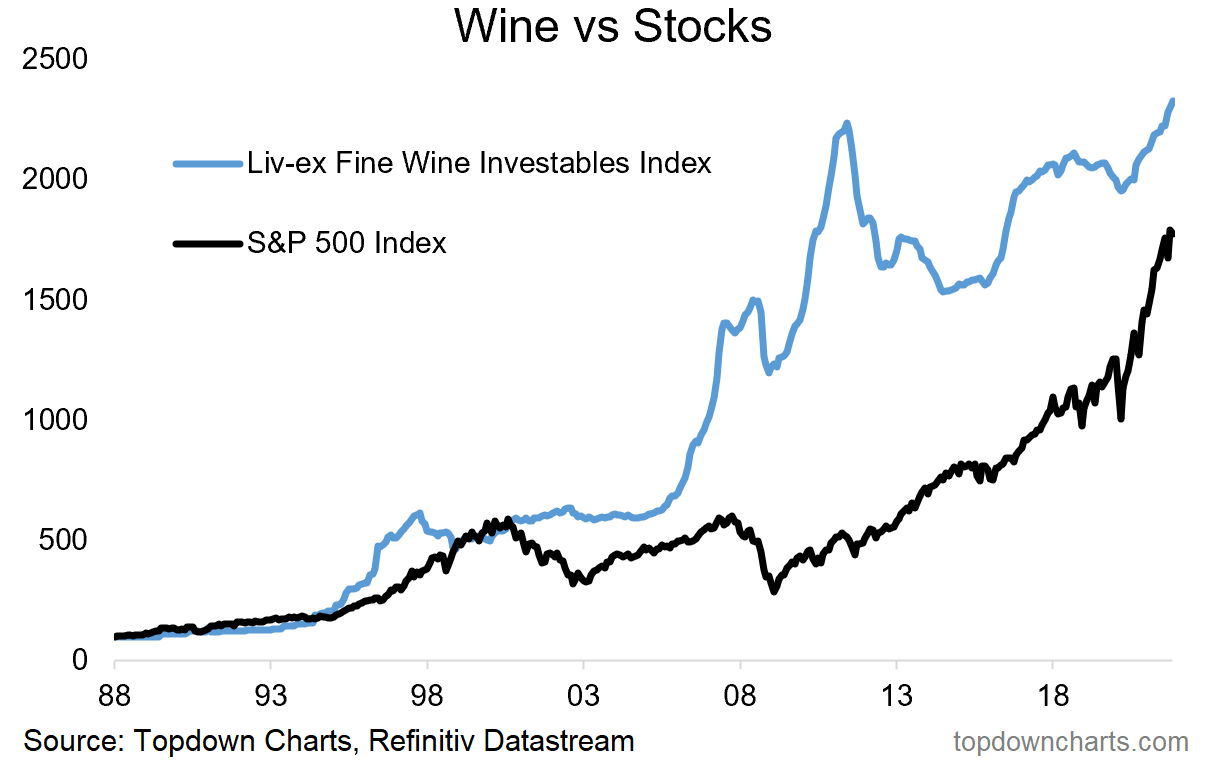

And Lastly… A Nice Burgundy, or the S&P?

As we head into the festive season, and what looks like a less-than-festive season in stocks, the Liv-ex Fine Wine Index may be a bit more relevant than usual! Since inception, wine prices have more than held their own vs stock prices (albeit I would note that the above is price-only — so it doesn’t include the impact of dividends from stocks …or any “dividends“ from wine holdings!).

Seersite provides investors with insights, analysis, data and expert commentary on financial markets and investments.

Sign up for Seersite on our website or via our mobile apps. Download on iOS or Android.