IPO Winners (and Losers), China's Falling Property Prices, Boeing's Descent, and The Most Dubious Buy Thesis Ever?

Just the Best Investing and Business Insights

If you don’t have a Seersite account, sign up for free at seersite.com, or download the Seersite app on iOS or Android.

Most Read on Seersite This Week

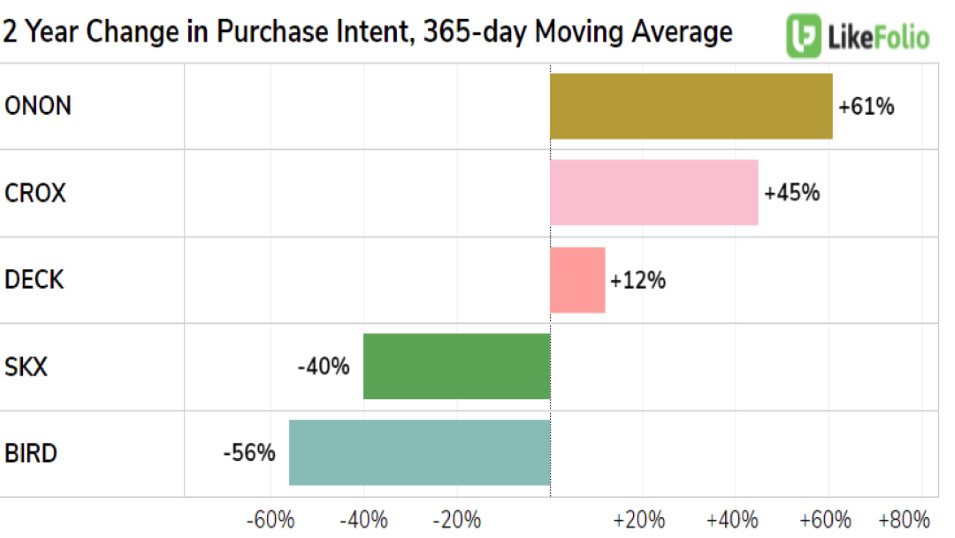

Using Data to Spot Potential IPO Winners...and Losers too (BIRD) | LikeFolio. We've tracked a flurry of new IPOs over the last few months. RIVN. HOOD. ONON. WRBY. BIRD. Analyzing consumer metrics can help to bring the potential winners...and more importantly losers to the surface. These losers are names that data suggests may already be tapped out when it comes to growth... One name on our radar: Allbirds (BIRD).

China Property - Signals From Weekly Home Sales Data | Real Estate Foresight. Our indicator based on the weekly new home sales data for 10 major cities in China (orange line on the chart, covering the period to week ending Nov 7) suggests no significant change in the direction of the monthly national home sales growth YTD y/y for Oct (the grey line).

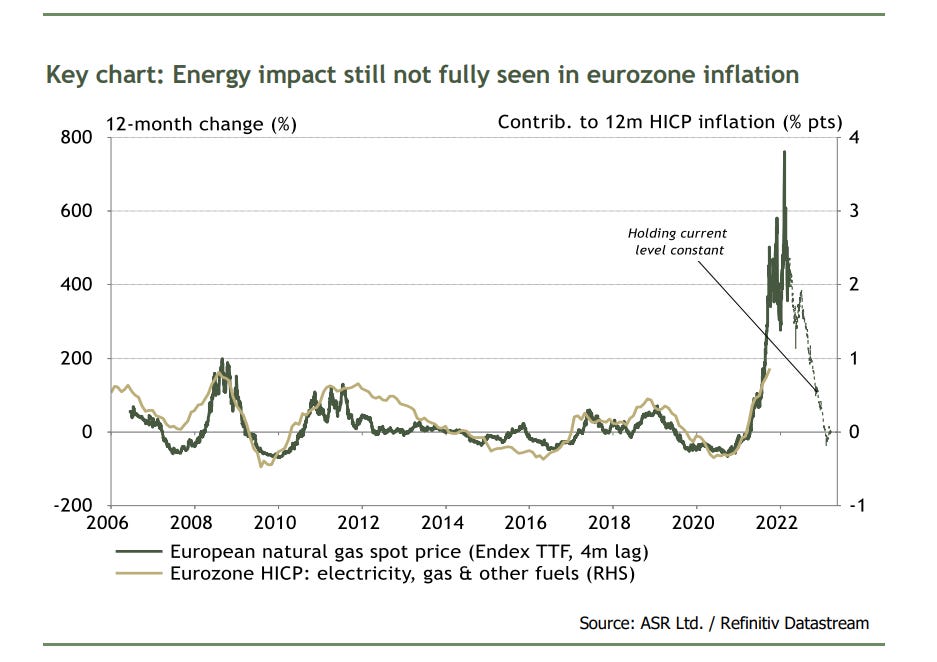

Europe’s Political Challenges Mount | Absolute Strategy Research. Europe is facing a number of short-term macro challenges. Inflation has spiked, supply-chain bottlenecks are hampering production, and a record number of firms are facing labour shortages.

Upcoming IPO's Report | Similarweb. Did you know that, in 2021, 1635 companies went public via IPO? Our data experts teamed up with @synaptic_data to create an alternativedata report analyzing 25 of the most prominent companies on track to IPO.

Boeing? Worst Company on the Planet? | Blain's Morning Porridge. A new book on the fall of Boeing is getting the headlines this morning. I’ve been arguing it illustrates all the worst excess of capitalism – yet how many investors have called it out? Very few. Why does ESG apparently not apply to Boeing?

Chart of the Week - China Property: House Price Growth In October

The recent discounting of new home prices started showing up in the aggregate price growth metrics from NBS, though so far not as significant as in 2014-2015 (chart below). The average non-weighted m/m price growth across 70 major cities was negative for the second consecutive month at -0.3% vs -0.1% for September, while the y/y growth decelerated to +2.8% from +3.3% in September. Chongqing (+8.0%), Yinchuan, Guangzhou, Jining, and Xi’an are top performers y/y. (read, from Real Estate Foresight).

Buy, Because This Has All The Credentials of a Top Meme-Stock.

Two posts lamenting the arguably frothy state of the market caught our eye this week. The first from Blain’s Morning Porridge, suggests it’s time to worry when “a distinguished market analyst described his premier stock pick, without a trace of irony, as you should buy, because this has all the credentials of a top meme-stock.” The other, from Topdown Charts, highlights the peak in the ratio of leveraged long v short ETF volumes, but concludes “Maybe we’ve just entered into a whole new even more frenzied phase of the bull market.” Does any value remain? Absolute Strategy Research suggests that “UK equities are screening as ‘cheap’ for many investors”. but that a worsening in the growth/inflation mix could render the market unattractive.

Contributor Spotlight: Revelio Labs

Revelio Labs is a workforce intelligence company. We absorb and standardize hundreds of millions of public employment records to create the world’s first universal HR database. This allows us to understand the workforce dynamics of any company. Our customers include investors, corporate strategists, HR teams, and governments. Read Revelio Lab's insights here.

And Lastly… Are the Tourists Here Yet?

The US borders finally opened on November 8. Did that result in a material influx of tourists that will help increase hotel and retail traffic? Not yet... (read, from Advan).

Seersite provides investors with insights, analysis, data and expert commentary on financial markets and investments.

Sign up for Seersite on our website or via our mobile apps. Download on iOS or Android.