Luxury Ideas, India v China, Clean Energy Minerals, and Yield-Free Risk

Just the Best Investing and Business Insights

If you don’t have a Seersite account, sign up for free at seersite.com, or download the Seersite app on iOS or Android.

Seersite Tip: Try the new Stocks tab in the Seersite mobile app. Price moves, stock charts, Seersite posts, and build a list of stocks to follow.

Most Read on Seersite This Week

Should You be Adding Some Luxury to Your Investment Portfolio? | Three Counties. Luxury brand share prices have rallied strongly over the past 12 months. Will this continue and where are the opportunities within this sector? Andrew Alexander discusses this with Swetha Ramachandran, Investment Manager at GAM Investments and manager of the GAM Luxury Brands fund.

Ukraine’s New Winter Wheat Crop Will be Significantly Larger than Last Year | Gro Intelligence. Much improved planting conditions lead to a 10% jump in winter wheat acreage. A favorable Ukraine crop would be good news for world supplies after disappointing harvests in the US, Canada, and Russia led to reduced global wheat production last season and lower world ending stocks. That has kept futures prices at levels not seen since 2014.

Keyence – Time to Step Off and Some Warning Signs for Markets | Lightstream Research. Keyence has been our top pick within the factory automation sector for some time and has consistently outperformed peers. We still consider it the highest quality name within the sector but given valuations, we are reluctantly disembarking here.

Tesla's August Sales Numbers in China Don't Add Up | Vicki Bryan, Bond Angle LLC. New data out this week revealed much weaker monthly sales in China in August versus previously reported. So different it looks like Tesla may have reported misleading data to Chinese authorities.

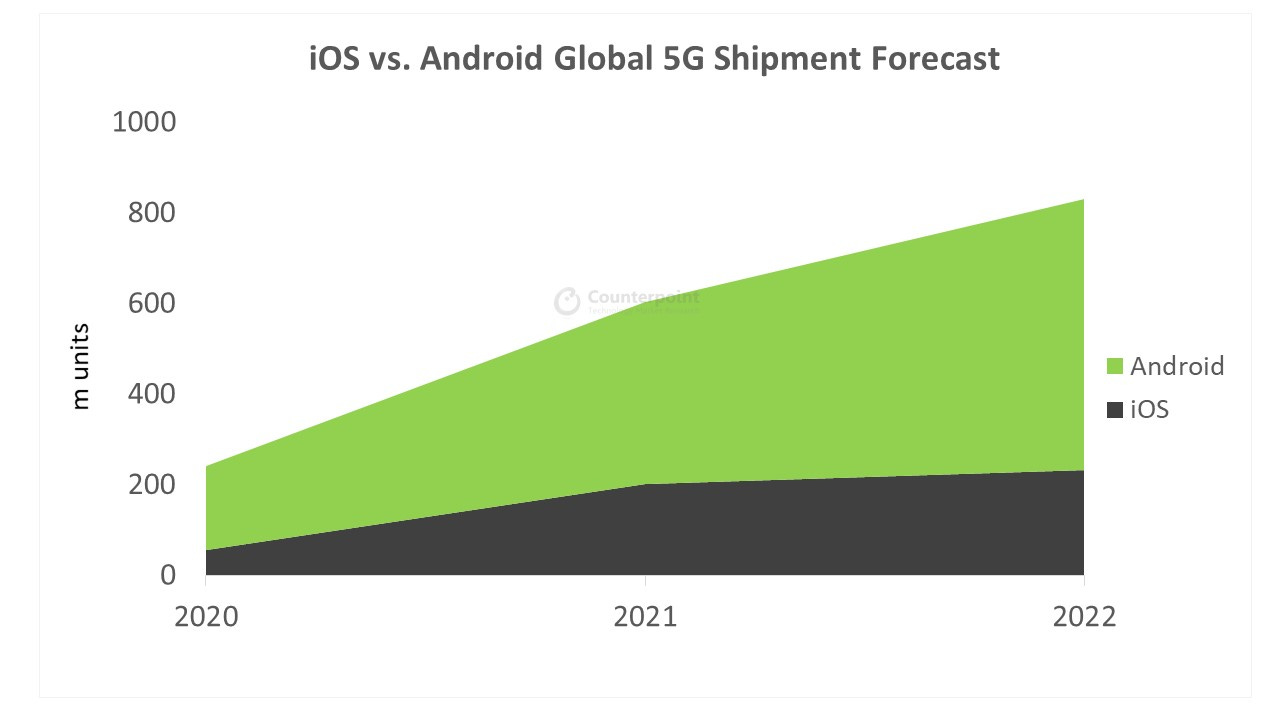

Apple Notes and Numbers | Counterpoint Technology Market Research. It was a mutually beneficial relationship between the iPhone 12 and US operators that contributed greatly to the stellar show of Apple’s first 5G series. The operators want more subscribers on their 5G networks and Apple wants to expand its iOS installed base. Will the iPhone 13 series fetch similar promotions and discounts?

As China Falters, Could This Be India’s Decade?

After a week in which Evergrande shook the world and the risks of both Chinese debt-led growth and Xi’s shift towards a more socialist economy became ever more apparent (read Blain’s Morning Porridge’s take here, and Stratton Street Capital’s here), the idea that the 20’s might be India’s decade is gaining currency. Quantum Advisors India makes the case for India for investors seeking a balanced Asia portfolio (read) , and also compares the growth of India and China from an ESG perspective (read). The Emerging Markets Investor asks whether India is assuming leadership in Emerging Markets (read), while Aubrey Capital Management argues that the Indian economy is in good shape and at a favourable stage in the economic cycle, and explains why India is the largest country exposure in their Global Emerging Markets Opportunities Fund (read).

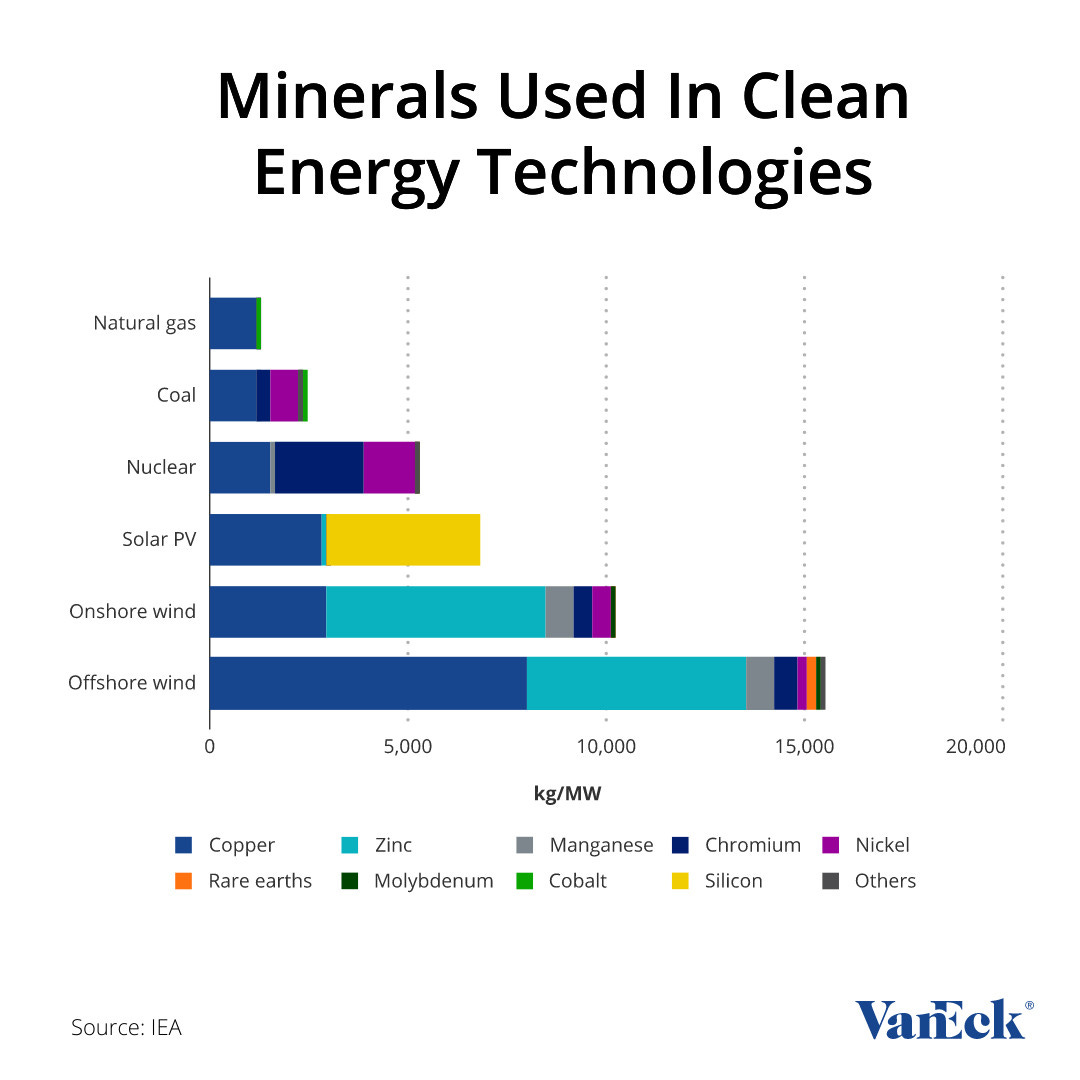

Chart of the Week - Mining a Solution for Clean Energy

As the U.S. digs full force into new green initiatives like solar, and electric cars, investors often overlook the minerals that make the production of these technologies possible. The path to clean energy leads us underground, as mining becomes the solution to going green (read, from Van Eck).

Contributor Spotlight: Apptopia

Apptopia is the leader in real-time competitive intelligence. Brands and financial firms use our platform to generate insights across mobile apps and connected devices. Powered by machine learning technology, we collect and analyze billions of complex data points to surface critical business signals. Financial analysts access our data analytics via the Bloomberg Terminal to generate revenue estimates, monitor consumer engagement across devices, and gain insight into competitive positioning. Read Apptopia's insights here.

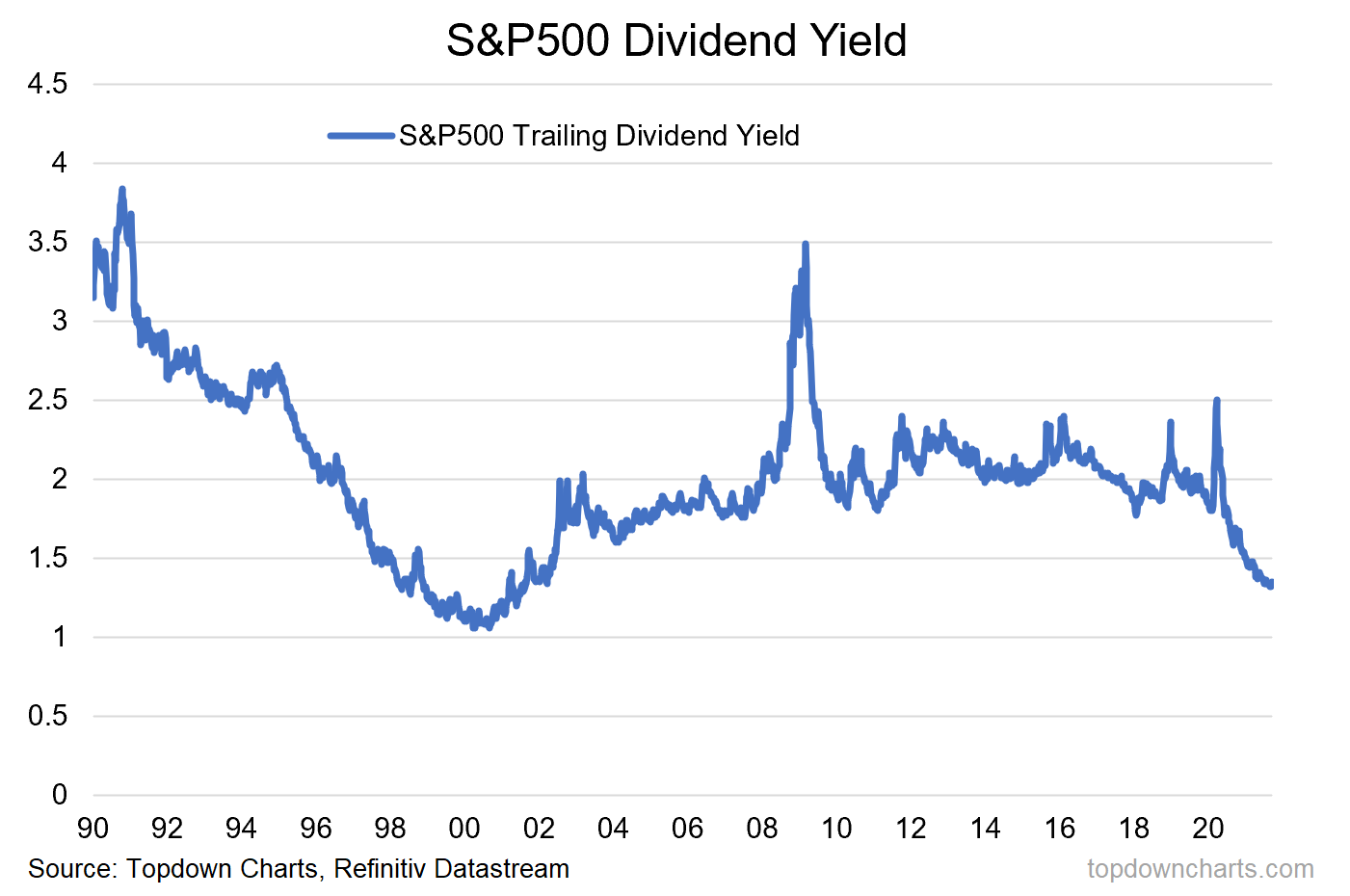

And Lastly… Yield Free Risk?

The flipside of the dream run in stocks is the plunge in dividend yields - down to a 2-decade low and the same level as 10-year treasury yields! (read, from Callum Thomas).

Seersite provides investors with insights, analysis, data and trends on financial markets, stocks and companies.

Sign up for Seersite on our website or via our mobile apps. Download on iOS or Android.